With the Fed’s recent interest rate cuts signaling lower interest rates, demand for housing has begun to return, according to a recent report from online brokerage firm Redfin ( RDFN ). The company reported an impressive 9% month-over-month increase in the Homebuyer Demand Index. However, sales have not returned to pre-pandemic levels, and the future is uncertain. Redfin suffered a sharp decline in revenue and earnings as rising interest rates caused the housing market to decline.

Although the latest quarterly results are as expected, it is still far from profitable. The stock has jumped 73% in the past 90 days, largely due to climate change. Investors interested in the real estate market may want to keep an eye on the RDFN for other signs of positive results before committing to the stock.

Redfin Struggles With Real Estate Sales for a Decade

Redfin Corporation uses technology to provide real estate services, such as buying and selling real estate, title and settlement, and leasing and selling real estate. Its online platform is also used for on-demand home tours, quick rentals, and title services. The company currently operates over 100 markets.

A recent report by Redfin shows a sharp decline in US residential foreclosures in the first eight months of 2024, the lowest in decades, with only 25 out of every 1,000 homes sold. This shows a decrease of 37.5% compared to the 2021 pandemic buying period and 31% less than the year before 2019.

Factors that have contributed to this decline include high interest rates, which have prevented homeowners from selling due to high prices, rising home prices, and a decline in pre-listed homes. The economic and political uncertainty surrounding the upcoming US presidential election has led to a wait-and-see approach.

Analysis of Redfin’s Latest Financial Results & Outlook

The company recently reported the results of Q2 2024. The revenue was $ 295.20 million, an increase of 7% year-on-year, beating the expectations of experts of $ 291.39 million. Gross profit also increased by 9% to $109.6 million. On the other hand, the gross profit of real estate services decreased by 4% from last year, at $ 53.7 million, and its margin decreased to 29% compared to 31% in Q2 2023.

Redfin reported a net loss of $27.9 million, slightly higher than last year’s $27.4 million. However, adjusted EBITDA showed a significant improvement from a loss of $6.9 million in Q2 2023 to a stable level this quarter. CEO Glenn Kelman says the profit growth is due to quality and operational improvements and he has a positive outlook for the company’s financials. The company posted earnings per share (EPS) of $0.23, topping the consensus estimate of $0.26.

Following the results of the second quarter, RDFN management has given guidance for Q3 2024. Revenues are expected to be between $273 million and $285 million, indicating annual growth of 1% to 6%. However, the company expects a total loss between $ 30 million and $ 22 million, more than the $ 19 million loss in Q3 2023. Adjusted EBITDA is expected to fall between $ 4 million and $ 12 million.

What is the current price of RDFN Stock?

The stock has fallen steadily since its peak in 2021, losing 77% over the past three years. However, the recent rise in share prices, likely driven by Fed rate hikes, has given life to the fundamentals. It trades in the upper half of its 52-week price range of $4.26 – $15.29 and shows positive price growth, trading above the 50-day (10.28) moving average. The P/S ratio of 1.3x is below Real Estate Services’ average of 1.8x, indicating the business trades at a slightly lower price to its industry peers.

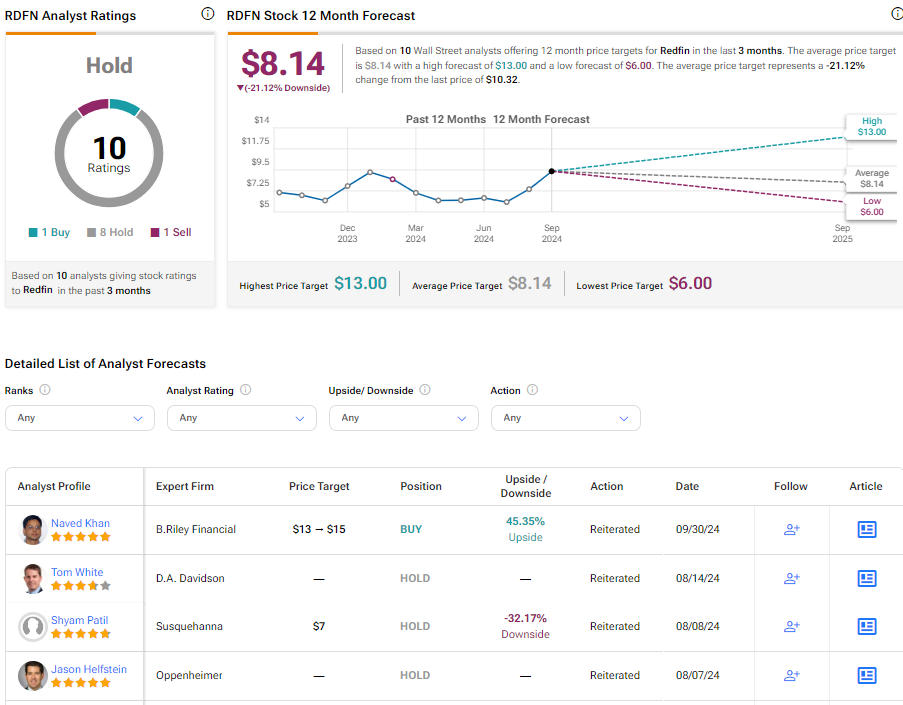

Analysts covering the company have generally taken a wait-and-see approach to RDFN stock. Based on ten review recommendations, Redfin rated Hold. The stock price of RDFN is $8.14, which represents a decrease of -21.12% from the current price.

See more RDFN reviews

RDFN in Comments

Redfin is showing signs of recovery amid the troubled housing market, led by the Fed’s recent rate cut. Although the company’s performance is still very low, it has experienced a significant increase in its shares. However, US home prices have fallen slightly, and economic and political uncertainty is looming. The company’s Q2 2024 financial results show progress, exceeding analysts’ expectations, but the company still lost net income.

With signs of potential growth in the real estate market, investors may want to watch RDFN for opportunities. However, caution is recommended, as the company is expected to post another loss in Q3 2024.

Disclosure

#Redfin #RDFN #Drops #Earnings #Real #Estate #TipRanks.com